“The Global Electric Vehicles Motor Market size is expected to reach $19.2 billion by 2028, rising at a market growth of 20.4% CAGR during the forecast period”

Electric Vehicles:

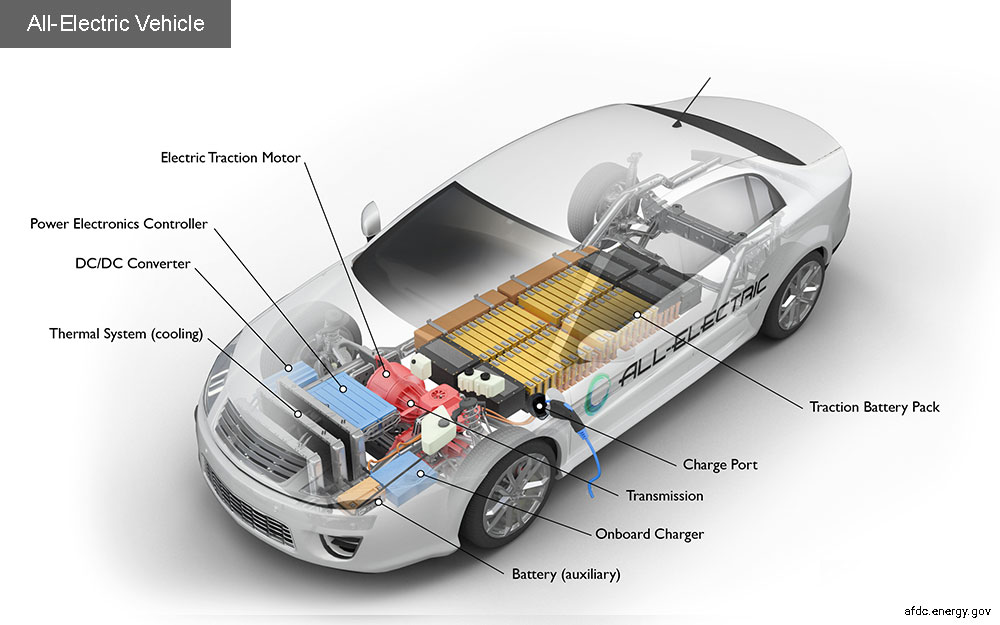

An electric vehicles (EV) motor is an electromechanical device that completely transforms electric energy into mechanical energy to control EVs. An electric vehicle engine’s orientation, end section, shape, rotor, stator, and cooling edge are crucial. Modern electric vehicles are made to manage both DC and AC power internally. Although the battery holds and distributes DC, the motor also requires AC.

With Levels 1 and 2 charging, the energy enters the onboard chargers as AC, while with Level 3 fast chargers, it enters as DC high-voltage current. Power electronics are used to handle the numerous onboard AC/DC conversions. These are especially needed when stepping the voltage from 100 to 800 volts of charging strength to battery/motor system voltages ranging between 350 and 800 volts to the numerous vehicle lighting, chassis, and infotainment functions that need 12-48-volt DC electricity.

Two key components are present in all-electric vehicle motor types. The stator, whose housing is attached to the chassis, is the stationary exterior casing of the motor. The rotor, which is the only spinning component, and functions similarly to a crankshaft as it distributes torque to a differential and the transmission.

In order to reduce the speed difference between the motor and the wheels, the majority of EVs rely on direct-drive (single-ratio) units. Electric motors, like internal combustion engines (ICE), operate most effectively at low rpm and increased load. The fundamental rotor variations amongst the various motor types represent utterly distinct methods for converting the stator’s rotating magnetic field (RMF) into actual rotary motion.

#COVID-19 Impact Analysis:

The pandemic had a negative impact on the electric vehicle motor market. The COVID-19 pandemic’s effects have led to supply-chain disruptions, which have decreased sales of passenger automobiles and temporarily halted vehicle production all across the world. Compared to automobile manufacturing in 2019, there was a decrease in worldwide car production. A number of automakers experienced a shortage of parts, including semiconductor chips, which caused production to be delayed and, as a result, reduced sales of electric vehicle motor systems. It has been concluded that the COVID-19 pandemic temporarily decreased sales of electric vehicles, but it may also increase demand in the future, particularly for larger, more powerful electric vehicles. Due to COVID-19’s travel restrictions, import-dependent suppliers of materials for electric cars have been disrupted as well, which has encouraged the use of domestic alternatives and the stockpiling of necessary components.

##Market Growth Factor :

#Increased consumer interest in Electric Vehicles

A large demand for electric vehicles has emerged in recent years as numerous people are concerned about the potentially disastrous effects of climate change. This is further influenced by the appalling levels of pollution documented in the world’s biggest cities, which continues to rise. The loss of fossil fuel resources and the growing trend among businesses to derive the greatest possible profit from their oil reserves are both factors that contribute to the acceleration of demand growth.

#Consistently rising costs for gasoline and diesel:

The need for fuel, such as gasoline and diesel, has grown dramatically in recent years due to the rising demand for automobiles. Fuel costs have recently increased due to the rising cost of crude oil, which is used to make gasoline and diesel. At the start of the COVID-19 pandemic, crude oil was less expensive because of the temporary closure of numerous enterprises and the drop-in energy consumption. Costs have, nevertheless, dramatically climbed as a result of suppliers’ challenges in meeting consumers’ rising demands.

#Market Restraining Factor:

High cost of production offering an expensive end product

Given that the metals used in these motors are susceptible to export limitations and supply uncertainties, the electric vehicle motors manufacturers are anticipated to experience difficulties in the acquisition of rare earth metals required in permanent magnets for synchronous motors. Additionally, buying a vehicle with an e-powertrain costs almost twice as much as buying one with a standard gasoline engine.

#Type Outlook:

Based on type, the electric vehicle motor market is bifurcated into AC motor and DC motor. The AC motor segment acquired the highest revenue share in the electric vehicle motor market in 2021. A three-phase motor with a focus on speed is the AC induction motor and it can be powered by 240 volts. Because it contains regenerative capabilities that may also serve as a generator and supply power to the vehicle’s battery, this type of vehicle motor is regarded as versatile.

#Application Outlook:

Based on application, the electric vehicle motor market is categorized into passenger cars and commercial vehicles. The commercial cars segment witnessed a significant revenue share in the electric vehicle motor market in 2021. This segment’s rising growth is mostly due to the electric vehicle motor’s explosive growth. A commercial vehicle is any motor vehicle that is used to transport passengers or deliver goods. CMVs include, but are not limited to, pick-up trucks, semi-trucks, vans, buses, box trucks, coaches, taxicabs, travel trailers, and trailers.

#Electric Vehicles Type Outlook:

On the basis of electric vehicle type, the electric vehicle motor market is divided into battery electric vehicle, plugin hybrid vehicle, and hybrid vehicle. The battery electric vehicle segment procured the largest revenue share in the electric vehicle market in 2021. Instead of using any fuel at all, battery-electric cars are propelled only by the stored energy in a battery system, which drives one or even more electric motors while producing no pollution. These cars can usually be charged anywhere, at any moment, and normally for a lot less money than a gas fill-up.

#Regional Outlook:

On the basis of region, the electric vehicle motor market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment recorded the highest revenue share in the electric vehicle motor market in 2021.

The Asia-Pacific market is expanding as a result of rising vehicle requirements and a rise in vehicle ownership. Additionally, due to government measures, several technological developments in the area of electric vehicles are occurring, which further supports the expansion.

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Continental AG, Denso Corporation, Robert Bosch GmbH are the forerunners in the Electric Vehicle Motor Market. Companies such as Nidec Corporation, Magna International, Inc., Johnson Electric Holdings Limited are some of the key innovators in Electric Vehicle Motor Market.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Buhler Motor GmbH, Inteva Products, LLC (The Renco Group Inc), Mabuchi Motor Co., Ltd., Johnson Electric Holdings Limited, Continental AG, Denso Corporation, Magna International, Inc., Robert Bosch GmbH, Nidec Corporation and MITSUBA Corporation

#Strategies Deployed in Electric Vehicle Motor Market:

Nov-2022: Continental AG partnered with Sono Motors GmbH, a Germany-based electric solar car developer. Together, the companies aim to work on a climate-friendly mobility project.

May-2022: Continental AG released two new sensors for electrified vehicles named the Current Sensor Module (CSM) and the Battery Impact Detection (BID) system. Both these products protect the battery and maintain performance in electrified vehicles.

May-2022: Denso Corporation collaborated with Honeywell, an America-based multinational conglomerate corporation. Through this collaboration, Denso and Honeywell would co-develop an electric motor (e-motor) for the Lilium Jet and this product would mark the entry of Denso into the aerospace market.

Apr-2022: Denso Corporation came into collaboration with United Semiconductor Japan Co., Ltd., a subsidiary of global semiconductor foundry United Microelectronics Corporation. Through this collaboration, Denso and USJC agreed to fulfill the demand in the automotive industry by producing power semiconductors at USJC’s 300mm fab.

Feb-2022: Robert Bosch GmbH completed the acquisition of Atlatec GmbH, a high-resolution 3D maps provider for SAE Level 3 to 4 automated driving functions. Through this acquisition, Bosch reinforced the field of high-resolution digital maps and offers building blocks of automated driving from maps and software to sensors and actuators to customers.

Jan-2022: Robert Bosch GmbH signed a partnership with IRP Systems, a provider of electric powertrain solutions for e-mobility. Through this partnership, Bosch reinforced automotive manufacturing capabilities with IRP’s innovative e-powertrain technology to offer affordable, robust, and quality controllers for mobility OEMs in Europe and Worldwide.

Oct-2021: Johnson Electric Holdings Limited released an active moisture removal solution, a headlamp condensation management device. With this product, Johnson Electric aims to enhance the quality of life of people and provide safer, healthier, and more comfortable products.

Jun-2021: Mabuchi Motors Co, Ltd. completed the acquisition of Electromag SA, an expert in developing and manufacturing brushless DC motors to serve demanding healthcare applications. Through this acquisition, Mabuchi strengthened its medical market sales and enhanced its specialization in brushless motors.

Dec-2020: Magna International, Inc. signed an agreement with LG Electronics. Following the agreement, the companies established a Joint Venture Company named LG Magna e-Powertrain. The JV manufactures onboard chargers, inverters, and e-motors for some automakers, as well as manufactures related e-drive systems for assisting the emerging global shift for vehicle electrification.

Sep-2020: Denso Corporation unveiled a new Electric Power Steering Motor Control Unit (EPS-MCU). This product aims to make the automobile society safe and secure by offering enhanced handling and safety to vehicles.

Dec-2019: Nidec Corporation took over Roboteq Inc., an American ultra-low voltage (ULV) motor designer. Following this acquisition, Nidec offers ULV drives, precision gearboxes, and servo motors to AGV customers.

Jul- 2019: Continental AG opened a new Powertrain plant and expanded its business to Wuhu, China. This facility enhanced production capacity and offers low-emission combustion technologies and the latest energy vehicles.

Scope of the Study:

Market Segments covered in the Report :

#By Type

• AC Motor

• DC Motor

#By Application

• Passenger Cars

• Commercial Vehicles

#By Electric Vehicles Type

• Plugin Hybrid Vehicle

• Hybrid Vehicle

#By Geography

• North America

* US

* Canada

* Mexico

* Rest of North America

• Europe

* Germany

* UK

* France

* Russia

* Spain

* Italy

* Rest of Europe

• Asia Pacific

• China

• Japan

• India

• South Korea

• Singapore

• Malaysia

• Rest of Asia Pacific

• LAMEA

• Brazil

• Argentina

• UAE

• Saudi Arabia

• South Africa

• Nigeria

• Rest of LAMEA

##Companies Profiled:

• Bühler Motor GmbH

• Inteva Products, LLC (The Renco Group Inc)

• Mabuchi Motor Co., Ltd.

• Johnson Electric Holdings Limited

• Continental AG

• Denso Corporation

• Magna International, Inc.

• Robert Bosch GmbH

• Nidec Corporation

• MITSUBA Corporation

##Unique Offerings:

• Exhaustive coverage

• Highest number of market tables and figures

• Subscription based model available

• Guaranteed best price

• Assured post sales research support with 10% customization free.